Learn How it Works

To Pawn Your Asset

View our loan checklist and how it works information relating to our service we offer as a licensed pawnbroker. Cashfast as a moneylender, lends money according to the value of asset that borrowers provide as loan security. This asset is retained by Cashfast until the debt is fully repaid.

Quick Cash Loans are available from $500 up to $100,000 and advanced based on the value of your asset you intend to pawn and use as collateral.

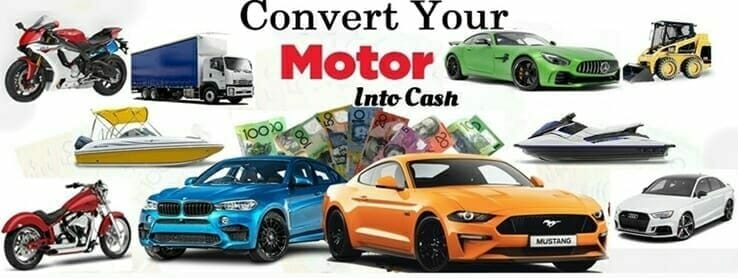

Type of Asset Pawned;

Include; Cars, Trucks, Motorcycles, Boats, Jet Skis and Machinery.

How it Works to Obtain a Loan?

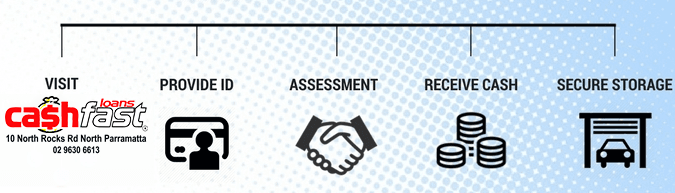

Visit our head office located at North Parramatta or learn more and view about us.

Loan Checklist

Get a Quick Cash Loan Today!

Bring and Provide;

Proof of Identification

- Photo identification = driver licence, photo ID or passport.

Proof of Asset Ownership

- Ownership document = registration certificate or sales receipt.

How it Works

- We’ll assess your asset and agree on an amount.

- Formalize contract.

- Receive cash or EFT, your choice.

Loan Contract Terms

- Contracts are generally short-term but can be finalized earlier or later with no penalty fee.

- Borrowers decide how long the loan is required, whether it’s 1 day or 365 days or more.

- Monthly loan repayments are not necessary for the first 3 months.

- You may at your choice pay periodically or at loan expiry.

- To extend the loan term, a fee must be paid prior to the final date of the loan term.

Frequently Asked Questions

Answers to Your Queries You May Have?

No employment necessary

Employment is not necessary when pawning an asset for a loan.

I don’t have a driver’s licence?

Any photo identification or documentation displaying name and address is suitable.

Do I require good credit score to obtain a loan?

Your credit rating or score is irrelevant to obtaining a loan from Cash Fast Loans.

Can I pawn a vehicle that’s unregistered or registered in another state?

Yes, providing ownership can be verified either by documentation or online.

Does vehicle ownership or registration have to be in my name?

This is not necessary; simply provide sufficient proof you have rights and are justified in pawning the asset.